Institutional Real Estate & Consumer Brand Investments

R&H Capital’s evergreen fund targets 18% IRR through disciplined acquisitions, value-add strategies, and vertical integration with high-growth consumer brands.

Evergreen Private Equity Platform | Institutional Discipline

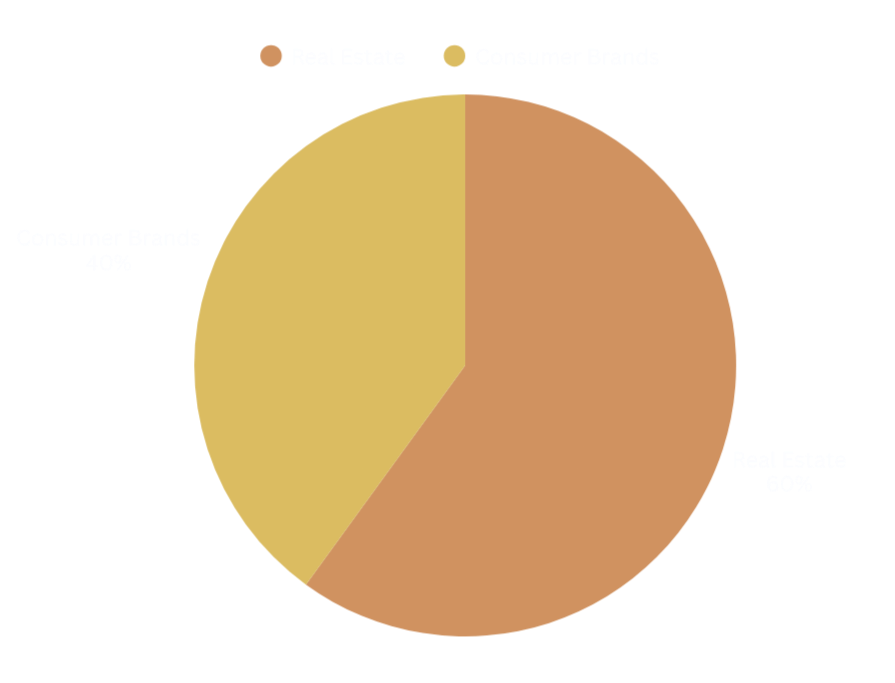

R&H Capital combines the stability of commercial real estate with the upside potential of consumer brands. Our evergreen fund eliminates traditional liquidity constraints, offering investors quarterly redemptions while targeting 18% IRR through a blend of core assets, value-add repositioning, and strategic brand integrations.

Real Estate

Core Assets:

Stabilized properties in top-tier markets (multifamily, industrial).Value-Add:

Underperforming assets with identifiable upside (repositioning, lease-up).Development:

Ground-up projects in high-growth corridors.

Consumer Brands

Vertical Integration:

Ownership of brands occupying our real estate (e.g., hospitality, retail).Exit Strategy:

IPO or strategic sale post-scale.

Fund Terms

Target Net IRR: ~18 % (net to investors)

Preferred Return: 8 % annual hurdle, cumulative and compounding

Redemptions / Liquidity: Quarterly, subject to 60-day notice and available cash flow

Fee Structure: 1.5 % annual management fee; 15 % performance allocation on profits above the preferred return

Structure: Evergreen private equity vehicle with a five-year initial lock-up, organized as R&H Capital LLC (Arizona)

Leadership with Proven Results

We align capital with opportunities that transcend market cycles—combining real estate’s stability with consumer brands’ growth potential.

David Robertson

CIO / Founder & Head of New Construction and Business Acquisitions

As CIO and Founder of R&H Capital, David Robertson secures exclusive off-market acquisitions in land, multifamily, and luxury developments, ranging from mid-eight to nine-figure transactions. He directs investment strategy, oversees underwriting, and leads due diligence on institutional-grade opportunities across key U.S. markets

Alex Rivera

Co-Founder & Head of Capital and value add Acquisitions

As Co-Founder and Managing Partner of R&H Capital, Alex Rivera leads capital strategy and value-add acquisitions across Class B/C multifamily and retail assets. He focuses on sourcing under-performing properties with repositioning potential and drives investment execution from acquisition to stabilization, strengthening investor confidence through transparency and disciplined underwriting.

Prefer to speak directly?

Schedule a confidential consultation with our team:

Get in Touch

Fill out the form below. Our Team will contact you back.